LB1237 and Why Nebraska Needs It

Every single child deserves to go to a school that best suits his or her needs, regardless of income or zip code. But in Nebraska, this is not the reality.

For example in 2017, Children's Scholarship Fund of Omaha turned away 635 applications due to lack of scholarship funds. However, LB1237 will help address this problem.

LB1237 (Opportunity Scholarships Act) will create a state income tax credit for donations to scholarship granting organizations, i.e., nonprofits that turn nearly all their revenue into private-school scholarships for low-income students. The bill allows for private, not public funds, for these scholarships.

Want to learn more about answers to common misconceptions about legislation like LB1237? Visit investinkidsnebraska.org.

Educational Freedom

Parents have the right to choose a school for their children which correspond to their own convictions and should have true liberty in their choice of schools. When we have true educational freedom reflected in state and national policy, financial burden will not prevent families from choosing the education that best suits their child's needs.

Macaria's Story

Macaria is a single mother of five children. Thanks to scholarships, all five children enrolled in Catholic schools.

"I wanted my children to attend private schools because they have a great education and teach things like respect, discipline and morality. The future looks nice today because I can see my children attending college. I thank [generous donors] for the support that is given to us with the scholarships, because in our situation, attending a private school would be impossible - just a dream."

Education Choice Policies

According to a 2017 EdNext poll, tax-credit scholarships are the most supported (55%), least opposed (24%) type of private school choice policy. Unlike vouchers and education savings account, tax-credit scholarships allow for private donations, not public funds, to help low-income children choose schools that are best suited for them.

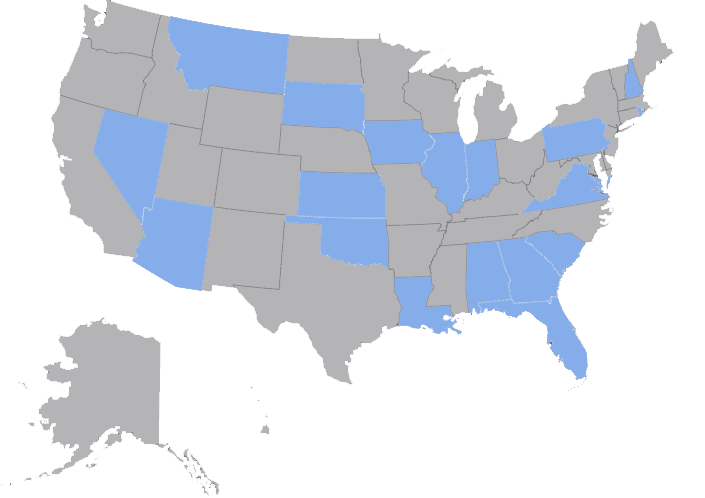

Tax-credit scholarship programs exist in 18 states, including Iowa, South Dakota, and Kansas (all states highlighted below). Florida’s tax-credit scholarship program is the nation’s largest, serving more than 97,000 students a year.

How does a tax credit scholarship work?

Find more education choice policy resources at EdChoice.