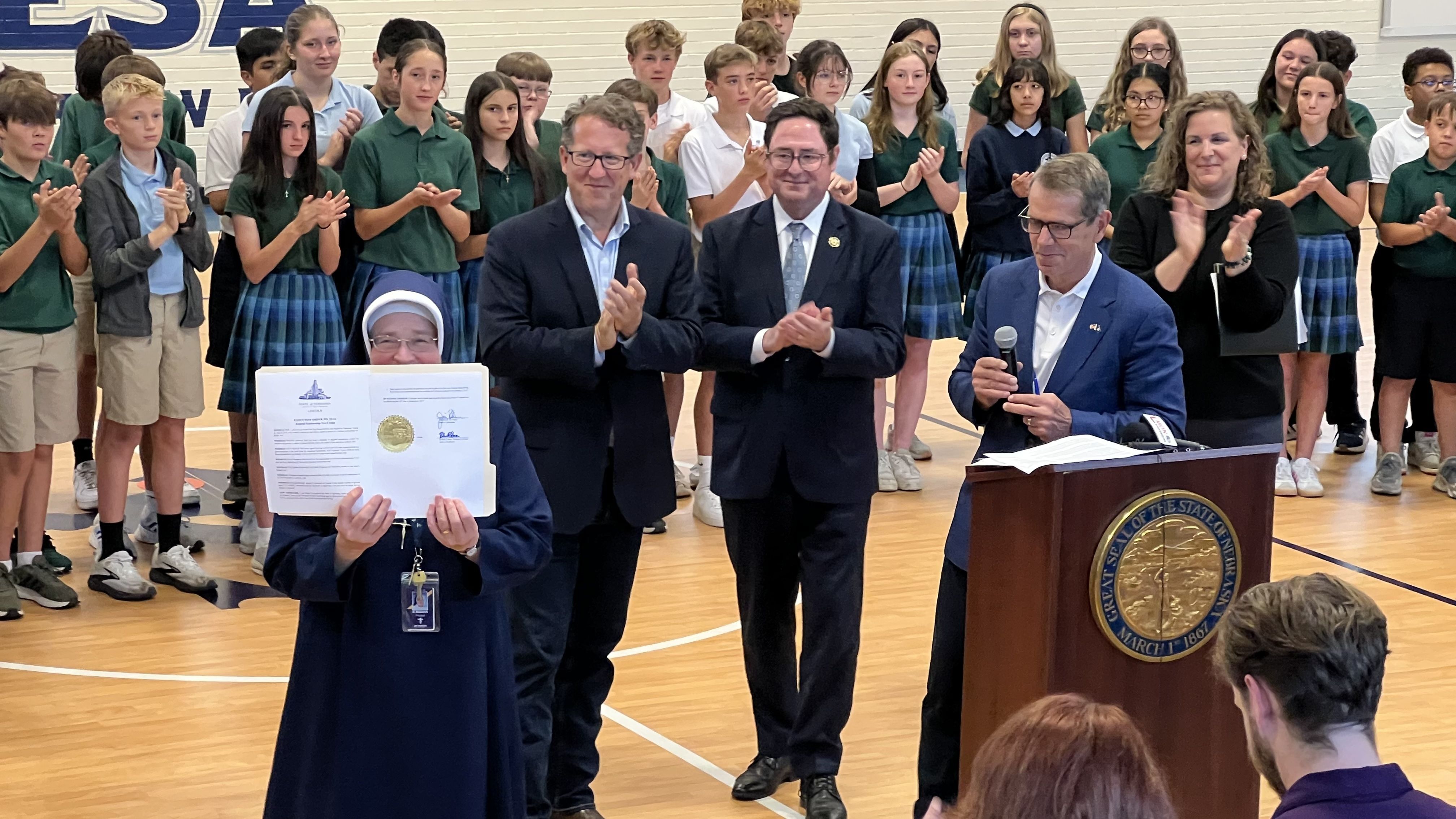

As you likely know by now, Governor Pillen formally announced that Nebraska will be opting into a federal school choice program. This announcement brings me a lot of excitement, and I want to share why I’m so excited. I hope you’ll share in this excitement.

Some Background. Before we jump into why this announcement is exciting, let’s review the nuts and bolts of this program. If you already know the basic program facts, choose your own adventure and skip down to my reasons for excitement.

The One Big Beautiful Bill Act was signed into law on July 4, 2025. Inside this new federal law is a federal school choice program that was notably championed by our very own Congressman Adrian Smith (huge kudos to him for his work on behalf of parents and students!).

School choice programs come in various shapes and sizes. This federal program is a scholarship tax credit. A scholarship tax credit allows taxpayers to receive an income tax credit for contributions to a scholarship granting organization which will turn those funds into education scholarships. More specifically, this new federal program will allow taxpayers to contribute up to $1700 to a scholarship granting organization and receive, in return, a 100% tax credit against their federal income taxes.

To be clear, taxpayers who make these contributions don’t make anything or come out ahead financially—and they also don’t lose anything. They simply get a chance to redirect a small portion of their tax liability for education scholarships. But you know who comes out ahead? Kids!

Eligible scholarship students will include public, private, or home school students, to cover costs like tuition and fees, special education services, before- and after-school programming, books and curriculum, and technology equipment and fees. Most students across the state will be eligible for these scholarships.

We can raise as much in scholarships as we can get taxpayers from Nebraska and across the country to make contributions to Nebraska-based SGOs, like Opportunity Scholarships of Nebraska.

But enough of the dry facts on how the program works, let’s talk about why this is exciting.

Education Changes Lives. We can’t hear it enough: kids only get one shot at their K-12 education, and we must make the most of that opportunity. Elementary and secondary education are critically formative for children. They learn to read, do math, and learn to wonder. They socialize, make friends, and learn to deal with conflict. They begin absorbing the culture and are taught (intentionally or not) how to judge and shape the culture. They learn (or don’t learn) about God and His unending love and mercy. Where a kid attends school matters, big time!

No student should be held hostage in a school that isn’t working for them. Their education shouldn’t be constrained by their zip code or financial status. Kids have the right to a school setting that helps them excel, and this federal tax credit program is going to further unleash the positive power of education for kids across Nebraska.

Parents Deserve Empowerment. The Catechism of the Catholic Church couldn’t be any clearer that parents are the primary educators of their children. Parents have a fundamental right and responsibility to access an education that is best for their children. It’s not the government’s job to stand in the way of that or to treat parents unfavorably for wanting different educational options for their kids. Instead, government should empower parents to have the rights and resources they need to select a school that is best for their children, and that’s precisely what the federal scholarship tax credit program will do.

The Stories Tell the Story. I’ve had the unique blessing to help pass two state school choice programs and be intimately involved in their implementation. I’ve seen firsthand and heard countless stories about the impact scholarships have had on families and kids.

Families who can now afford both groceries and tuition. Single Moms who can give up that second or third job and be at home in the evenings with her children. Parents who don’t have to take out that bank loan to cover tuition.

Kids who can escape a school where they are being bullied. Kids who are finally learning reading and math. Kids who are excited to be in a place where they feel loved, not just by their teachers but most importantly by God.

These stories abound, and these stories tell the story for why I’m most excited: school choice affects the lives of real people, our family, friends, neighbors, and strangers across the state, who deserve the best!

Join me in giving thanks to God for Governor Pillen’s courage to step up and step out to opt-in to this federal scholarship tax credit program. Let’s keep spreading the word far and wide, so every parent and child knows the hope ahead and every taxpayer knows to contribute to this hope!